Case Study

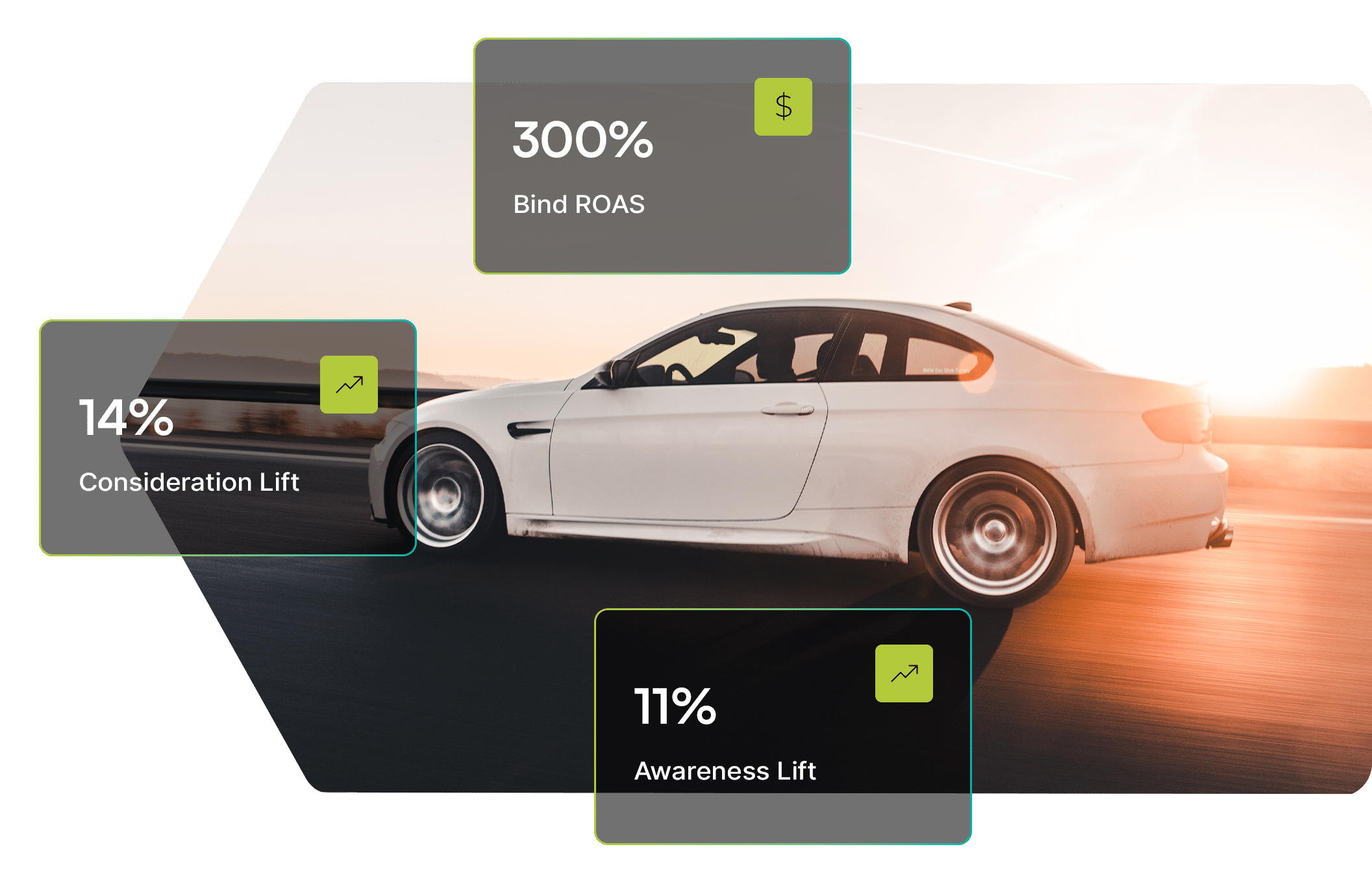

Performance campaign drives boost in web/app account creation and binds prior to an Initial Public Offering (IPO.)

We want your campaigns to thrive. Digital Remedy connects the right data to the highest performing channels to nail your dream KPIs—so you can feel confident your media spend is worth every penny.